Nuclear Industry Says Back on Track After Fukushima `Speed Bump’

Within months of the Fukushima nuclear disaster, the worst in 25 years, Germany, Belgium and Italy vowed to quit atomic energy. Twelve months on, the nuclear industry says it’s almost back to business as usual.

“Fukushima put a speed bump on the road to the nuclear renaissance,” Ganpat Mani, president of Converdyn, a company that processes mined uranium, said at a nuclear industry summit in Seoul last week. “It’s not going to delay the programs around the world.”

As Japan mourned this month for the 19,000 people killed or presumed dead from the earthquake and tsunami that also wrecked the Fukushima Dai-Ichi nuclear station, India last week overrode six months of local protests to approve the start of its Kudankulam plant. In February, the U.S. gave the green light to build the nation’s first reactor in 30 years. China is “very likely” to resume approval of new nuclear projects this year, said Sun Qin, president of China National Nuclear Corp.

With 650 million people in China and India living without access to electricity, the nations are looking to the atom to provide power without raising emissions and fossil fuel costs. Nuclear is not the only alternative to fossil fuels, but the use of renewable energy for now is restricted by technology and costs, according to South Korea’s Prime Minister Kim Hwang Sik.

Fifty Years

“It would be a more practical and viable solution, at least, for the next forty to fifty years, to make commitments to the safe use of nuclear energy,” Kim told the industry summit before welcoming counterparts including U.S. President Barack Obama for a nuclear security meeting that starts today.

Indonesia, Egypt, and Chile are among more than a dozen nations planning to build their first nuclear station to join the 30 countries operating atomic plants. Sixty one reactors are currently under construction and a further 162 units are planned, according to the World Nuclear Association.

The planned reactors alone have a greater capacity than all of the 435 reactors that supply 13.8 percent of the world’s electricity today. By 2030 at least 60 units will need to be retired, the WNA estimates. Still, global nuclear capacity may grow by about 50 percent to 600,000 megawatts by 2030, Areva SA (AREVA) Chief Executive Officer Luc Oursel told reporters in Seoul.

The nuclear industry has faced three major accidents in the last 32 years, with the first two delaying construction of atomic plants for decades in the countries where the disasters happened. The 1979 Three Mile Island core meltdown in the U.S. and the 1986 Chernobyl nuclear plant explosion in the former Soviet Union. And now Fukushima.

Waiting on Fukushima

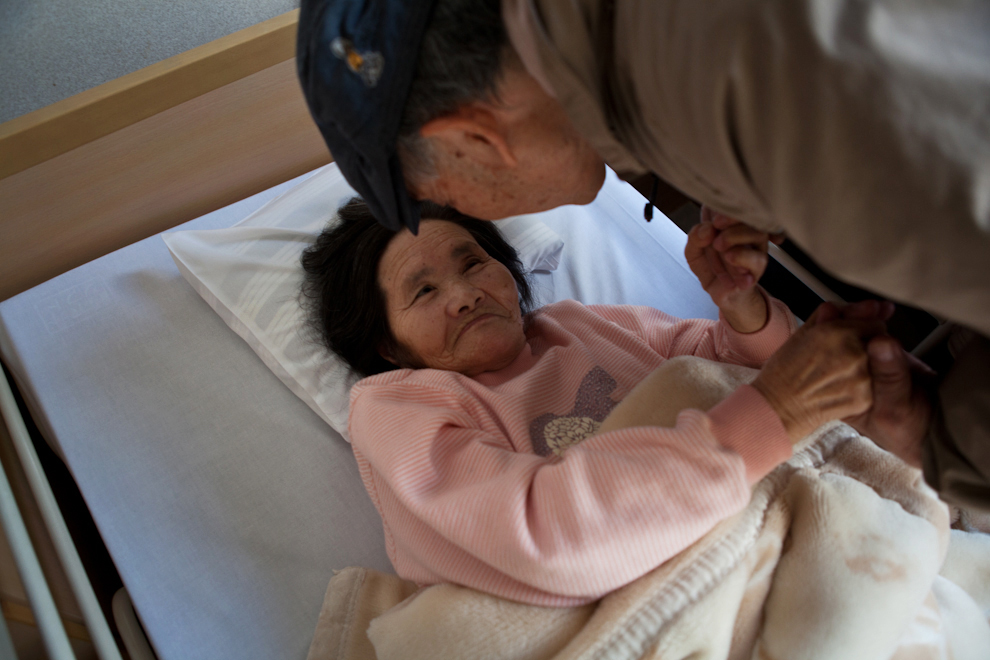

After the quake and tsunami engulfed Japan’s northeast coast the plant operated by Tokyo Electric Power Co. (9501) lost mains and battery power to cool its reactors, resulting in three core meltdowns and radiation leakage. About 160,000 people, or 8 percent of the Fukushima prefecture population, evacuated and about 132 square kilometers remain as a no-go zone around the station.

A unified report on Fukushima with an estimate of the total radiation fallout and the levels of food contamination will not be ready for at least another 14 months when the United Nations Scientific Committee on the Effects of Atomic Radiation issues its first global and independent assessment.

The industry has already learned lessons from Fukushima and they are incorporated into the safety systems of today’s power plants and the new models, said John Welch, chief executive officer of USEC Inc. (USU), the U.S. uranium enricher.

Amazed

“One thing that never ceases to amaze me about the industry, especially in the U.S., is that they take their job of running those plants safely and continuing to self-evaluate” very seriously, Welch said in an interview in Seoul.

France’s state-controlled nuclear company Areva will spend 2 billion euros ($2.65 billion) or a quarter of its investments over the next five years on safety improvements, Oursel said. U.S. utilities have installed an additional 300 piece of major equipment to boost safety since Fukushima, according to the Washington-based Nuclear Energy Institute.

The NEI, which represents companies including Exelon Corp. and Southern Co. (NSC), is also doubling its advertising spending to roll out a campaign from this month to promote atomic power. The campaign is due to feature in media including “The Daily Show with Jon Stewart,” the Emmy-award winning Comedy Central show, the Economist and Facebook.

'Different This Time'

“Different from past experiences in the U.S. nuclear industry we’ve spent a lot more time in the last year out in front of our stakeholders, the communities in which we operate, our elected officials, the citizens who work in our plants,” Charles Pardee, chief operating officer ofExelon Corp. (EXC), the biggest U.S. utility, told the Seoul forum.

“We’ve done this to make sure we’re as transparent as we can possibly be about what we’ve learned from these experiences and what we’ll do better going forward,” he said.

Still, safety improvements and mass campaigns will not be the clincher for whether nuclear power succeeds or loses out to a glut of natural gas from shale rock deposits or renewables, said Helmut Engelbrecht, chief executive officer of Urenco Ltd., the uranium enrichment company owned by the U.K., Germany and the Netherlands.

“In the long run our industry will only be successful if we prove that we are a competitive alternative to other forms of electricity,” Engelbrecht said in an interview in Seoul. That means competing on cost as much as proving its safety credentials. The industry is 10 years away from achieving this competitiveness, he said.

New Markets

Areva’s market outlook is more positive. There are many tenders for new reactors and other contracts out there, Oursel said. “When we now look at the global situation, we think it’s going to pick up very soon,” he said.

The future of nuclear demand lies in expansion to new countries as well as ongoing construction in India, China and Russia, Converdyn’s Mani said. India, which gets 3 percent of its power from nuclear energy, had targeted a 13-fold increase in capacity to 60,000 megawatts by 2030 prior to Fukushima.

China has 26 units under construction in addition to 15 operating reactors, according to the WNA. A further 51 units are planned and 120 proposed, meaning that China may account for a third of all the new construction, WNA data show.

The so-called nuclear renaissance isn’t limited to Asia’s economic growth. Countries including Poland and Turkey say that the risks and costs of rising fossil fuel prices and security of supply make nuclear generation a must for them.

Saving Money

Turkey’s disagreement with Russia’s OAO Gazprom (GAZP) over discounts led to the cancellation of a contract for as much as 6 billion cubic meters of annual gas purchases last year. By building two nuclear plants the country can cut its dependence on gas imports from Russia, its biggest fuel provider, and save as much as $7 billion over four years, Energy Minister Taner Yildiz said Dec. 15.

For companies like Kazatomprom, the state nuclear company of Kazakhstan, the world’s largest uranium exporter, that bodes good profits. The company is a shareholder in Toshiba Corp. (6502)’s Westinghouse Electric, which is due to build the first new U.S. reactor in 30 years in Georgia State. Kazatomprom also has ventures with Russia’s Rosatom Corp., which is due to build and run Turkey’s first nuclear plant.

“If our plans come off then the partnerships will be very profitable,” Kazatomprom president Vladimir Shkolnik said in an interview in Seoul. Both Rosatom and Westinghouse are going into new markets, which opens export avenues for the Kazakh company, he said.

The disaster at Fukushima has provided “many lessons, especially on how important nuclear safety is,” Kim Jong Shin, chairman of Korea Hydro & Nuclear Power Co. told reporters at the Seoul summit.

Still, the technology has no alternative that can provide “clean and sustainable energy,” Kim said. Given its role in medicine and national security, nuclear is “indispensable.”

To contact the reporters on this story: Yuriy Humber in Seoul at yhumber@bloomberg.net; Sangim Han in Seoul at sihan@bloomberg.net; Shinhye Kang in Seoul at skang24@bloomberg.net